Investing in Real Estate as a Hedge Against Inflation

If you’ve been paying attention to the news then you know that inflation has been driving up prices throughout our economy.

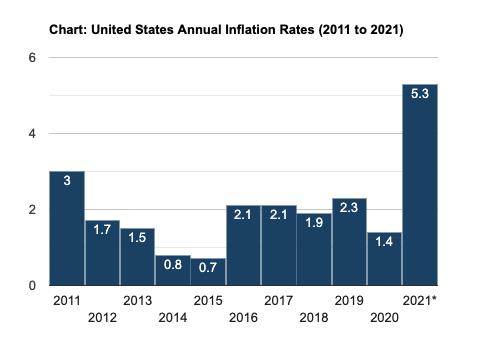

The Federal Reserve targets 2% as the yearly increase in the Consumer Price Index, which is comprised of various goods and services that the fed tracks to measure inflation. We first started seeing inflation creep up in March, 2021 when it increased from 1.7% in February to 2.6%. One month later, in April, it nearly doubled to 4.2%. Then in May, it hit 5% and now, through August, it hasn’t gone below 5%.

As you can see from the chart above, this is a huge jump from inflation rates over the last decade.

And we’ve seen the cost of some items go through the roof.

The cost of lumber has been up over 300% from last year.

Corn prices are up 85%

Crude oil prices are more than double what they were in 2020

Steel prices are setting record highs

Average home prices are up nearly 10% from last year

And used car prices have risen over 10% in one month alone.

Now the real question is, to what extent will the overall inflationary environment we’re in just be temporary or transitory in fed-speak, versus long term price increases. At this point, only time will tell.

What is clear is that in purchasing power, a dollar today buys less than it did in 2020. So, you should be investing in assets that beat inflation. If you aren’t, then you’re current and future purchasing power is going backwards you’re essentially losing money.

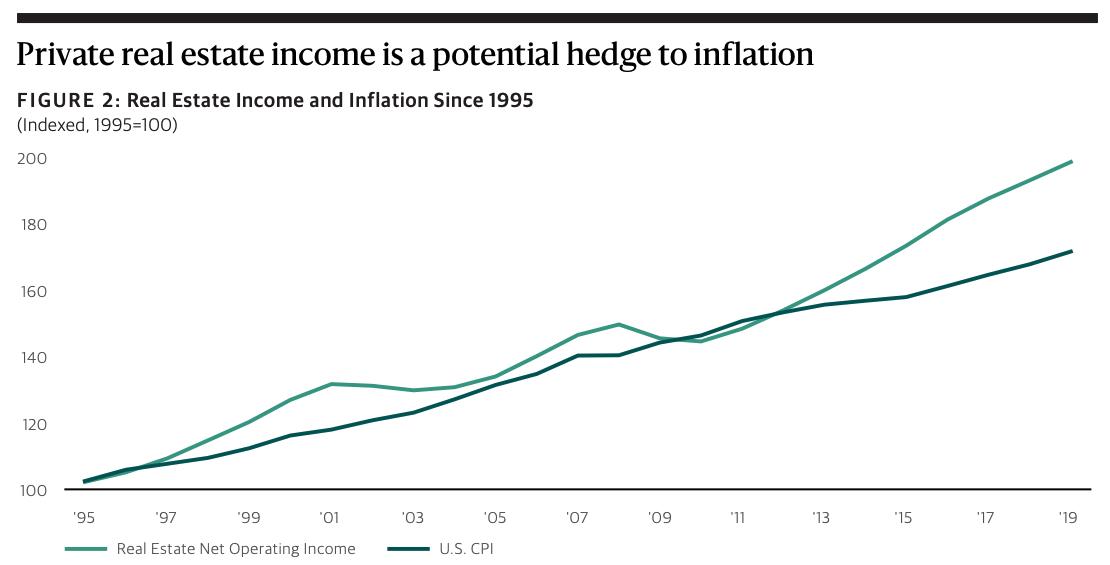

Historically, real estate has been a strong hedge against inflation because both real estate income and real estate values have outpaced inflation.

First, let’s look at real estate income. This chart measures the average growth in commercial real estate net operating income, compared to the increase in the Consumer Price Index.

Except for the 1995 recession and the Great Recession in 2009 to 2010, real estate income has consistently increased more than inflation, as measured by the CPI.

This is consistent with all of the properties that Prosperity CRE owns and asset manages for our investors. We’ve been able to raise rents at both our multifamily properties and our other commercial properties, which keeping occupancy in the mid to high 90%.

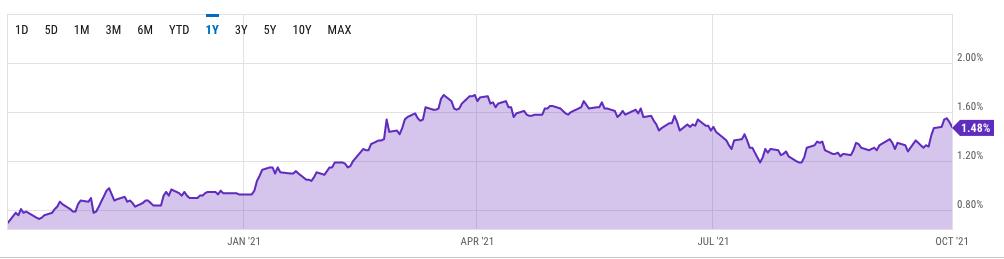

As the price of goods and services rise, we will frequently see interest rates rise as well. So, what impact do rising interest rates have on real estate values?

Here’s a chart of the 10 Year Treasury Rate over the last 5 years. As of October 1st, 2021, the interest rate was 1.48%. It’s been creeping up from a low of 0.52% in August, 2020.

Now let’s take at whether real estate values have increased or decreased during periods when interest rates have been increasing.

As we can clearly see, during periods when interest rates have been rising, real estate values have also increased.

And this is also consistent with what we’re seeing in the market place.

The 10 Year Treasury Rate as doubled over the last year, increasing from 0.7% in October of 2020 to 1.48%. Over this same period, for multifamily and industrial properties, the two property types that Prosperity CRE is invested in, we’ve seen values continue to rise.

For most people, inflation means losing money. With the prices of goods and services going up, your money has less purchasing power.

But if history is a guide, by investing in real estate, you’ll be hedging yourself against inflation. Cash flow from real estate investments have historically risen faster than inflation, and the value of real estate has increased when interest rates are rising.

We hope you found this article helpful. If you’d like to learn more about Prosperity CRE’s approach to real estate investing to generate ongoing cash flow and building long term wealth, you can receive a complimentary copy of our real estate investment book by clicking the link below.

ORDER FREE BOOK